Complete Guide to NetSuite Expense Management for Australian Businesses

For many finance teams across Australia, mastering NetSuite Expense Management can feel like a never-ending battle if the system is not configured correctly. The familiar cycle of chasing receipts, correcting spreadsheet errors, and dealing with slow reimbursement approvals is a significant drain on time and resources that can harm both productivity and employee satisfaction.

If this situation sounds familiar, your business is not alone. The good news is that for organisations using NetSuite, a powerful, built-in solution exists to solve these exact problems. At OneKloudX, we specialise in helping Australian businesses unlock the full potential of their NetSuite investment, and we consistently see clients achieve significant efficiency gains by properly configuring their Expense Management module.

How NetSuite Expense Management solves common challenges

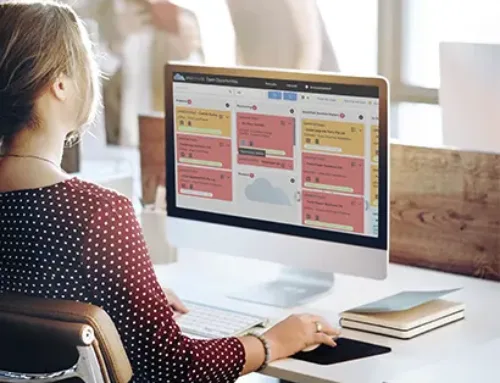

The core strength of NetSuite lies in its ability to replace disconnected, manual processes with a single, automated system. It provides a central hub for every stage of the expense lifecycle, from an employee capturing a receipt on their phone to the final payment being processed by your finance team. This eliminates the need for paper forms and dramatically reduces the chance of human error. By making the process simpler for everyone, you create a more efficient and accurate system from the ground up.

- Accelerating Reimbursements with Automated Workflows

Few things damage employee morale more than long waits for expense reimbursements. These delays are often caused by bottlenecks in the approval chain, where a report can sit inactive on a manager’s desk for days. NetSuite breaks this cycle with automated approval workflows. You can build custom routing rules that reflect your company’s structure, ensuring reports are sent to the correct manager instantly. When an expense is approved, the integration with NetSuite’s Accounts Payable functionality means that payments can be processed far more quickly, keeping your team happy and engaged.

2. Gaining Financial Control with NetSuite Expense Reporting

Do you have a truly clear, up-to-the-minute view of what your team is spending? For many businesses, the answer is no. When data is scattered across spreadsheets and email threads, finance leaders lack the visibility needed to manage budgets effectively. NetSuite transforms this with real-time dashboards and comprehensive reporting. You can see spending patterns as they develop, track expenses against project budgets, and analyse expense data to gain a holistic view of your financial health. This level of insight allows for proactive decision-making rather than reactive problem-solving.

3. Integrating Expense Management with Your NetSuite ERP

One of the most significant advantages of using NetSuite is its unified platform. The Expense Management module is not a separate piece of software bolted on; it is seamlessly integrated with your core financial, project management, and payroll systems. This means there is no need for manual data reconciliation between different applications, which is a common source of errors. For any service-based business, this integration is a game-changer. You can directly link expenses to specific customer projects, ensuring every billable cost is captured and invoiced correctly, protecting your revenue and improving project profitability.

4. Enforcing Policy and Strengthening Compliance

Ensuring every expense claim adheres to company policy can be a difficult and sensitive task. NetSuite helps you automate compliance by allowing you to embed your specific rules directly into the system. You can set spending limits for certain categories, flag transactions that fall outside policy, and define permissions based on employee roles. This proactive approach significantly reduces the risk of non-compliant spending and potential fraud. It also provides a clear, auditable trail for every transaction, simplifying compliance and providing peace of mind.

NetSuite Expense Management FAQ

See NetSuite Expense Management in action

Moving from a manual process to an automation-driven one can transform your business. By leveraging the tools already within your NetSuite platform, you can save countless administrative hours, improve financial visibility, and build a more compliant and efficient operation.

Access our OneKloudX-created NetSuite Expense Management User Guide for practical steps to help you configure and use the tools already in your system. This guide is designed for current NetSuite users who want to work more efficiently and get better control of company spending.